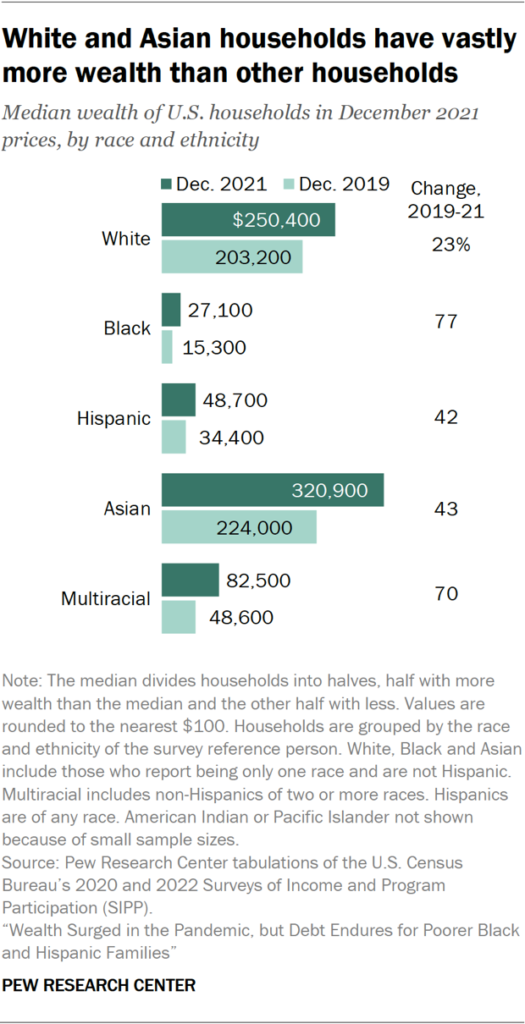

I came across this research from Pew Center which showed that Asian households, had significant more wealth than other racial groups in America. While the article focuses on the external factors that contribute to the disparity in wealth it does not talk much about intrinsic factors at all. For example, many Asian families living in America live well within their means, many families do not have high debt and look to squeeze out maximum value out of their earnings. This post is a reflection on spending and financial thinking that probably is the single biggest factor in explaining this chart.

When I first moved in to America, I realized the importance of Credit History. One needed to have “credit history” that shows the banks how good you are at returning money that you owe to qualify for things such as internet and phones. You are taught to get a credit card as soon as you come to the country so that you can build your record and establish yourself as a trustworthy person in the eyes of the lenders. While banks back home levy high interest rates, and entice you to spend less on credit cards, banks here offer rewards, and almost nonexistent interest rates on credit cards encouraging spending. Growing up in a family of bankers I was ever conditioned to the idea of avoiding debt, but over here I was pretty shocked to see young people own a multitude of cards and advertise the benefits of the cards. America in general seem to strive on high-risk high reward model. People flock to get new cards that offer rewards, that you can spend elsewhere. Every purchase had a cashback option and allowed the consumer to accumulate points. Airlines, Stores offer their own cards that promise great discounts on purchases.

My American friends advise to me to get the cards from a wide variety of banks and stores because then I would be rewarded for the spending but on the other hand my Asian friends recommended that I seek cards that offered rewards and benefits. Some credit cards offer benefits like Car Rental insurance, insurance on purchases etc. Banks would offer higher rewards on certain categories in some quarters, my Asian buddies had tabled charts that showed which cards to use when. The mindset difference was stark, while both sides understood that credit was absolutely required one side seemed to look for comprehensive benefits. These things add up over time and you are more likely to benefit drastically by paying extra attention to your bank website.

Banks back home do offer in general much higher interest rates on savings accounts and other low risk investments. In America the banks interest rates are paltry, in fact one of the biggest banks in USA that I used offered a 0.01% interest rate! Switching to a High Yield Saving Account or a Money Market account can offer much higher interest rates (5% in 2023). All bank accounts are FDIC insured up to 250K (250 K per person in case of a joint account). When I opened my bank account, none of the bankers talked to me about the different options, it was an Asian American who told me the details. Once I found out, it took me about 10 minutes to switch the account type and benefit from the higher rates. The bank had also set me up with a premium type of account that warranted a higher bank balance. Turns out the premium type meant nothing other than a tag on the account. I switched to the basic account type that let me keep a much lower balance on my bank and transfer the rest to a savings account. Banks also offer Certificate of Deposits that in general offer a fixed higher interest rate for longer period of time. I have learnt to take benefit of these as wells. Banks offer promos that give high CD interest rates, it would be wise to monitor these and take benefit.

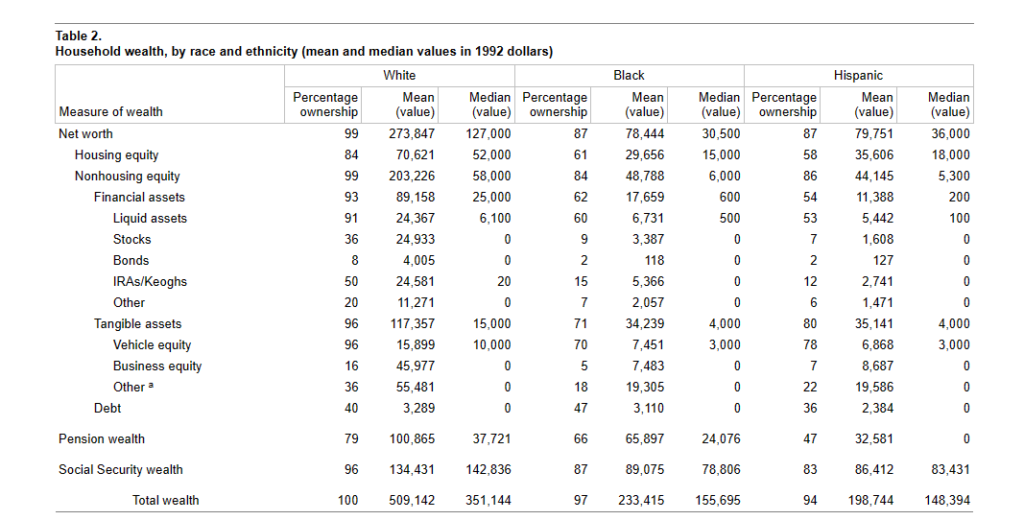

The table (1992 mean values of investments) shows the disparity between the races when it comes to long term investments. As you can see, to build generational wealth, financial assets need to be diversified and include high risk high return investments. White Americans in general tend to own more Bonds, IRA Stock that offer higher returns long term when compared to the other groups. Asians are not included in this table, but my feel is that they would mimic more of the White Americans behavior here but with a higher net worth in housing equity.

I used to buy the things I needed from the store closest to me, I did not care about the prices or the quality of the items I purchased. But over time, I have come to realize that the sales price of items was dependent on the location of the store as well and the brand value the store. Grocery stores in high income areas had a higher brand value and was pricier when compared to stores in low-income areas. I noticed how more affluent people thronged to stores such as Whole Foods, Central Market, Traders Joes, Costco while the not so affluent relied on stores such as Walmart, Fiesta etc. Over time we have noticed that we pick more fruits, vegetables when we visit stores like Central Market as opposed to a Walmart. These subtle shifts in diet do help in our overall health and keep the medical costs low overall.

I am not an avid shopper; I do not indulgently spend on things that I do not need. I do not seek to buy the latest gadgets. I seek to buy things that will serve me for a while. I do not agree with the idea of low-quality high fashion stores. I am 100% sure that many other people who figure in the list subscribe to this line of thought. The bottom line is that in order to build generational wealth, you need to walk a fine line between living frugally, avoiding debt, diversifying your investment instruments and more importantly understanding how to get the best value for your money.

P.S I am not a financial advisor, and I am not suggesting that you drastically change your investments portfolio in any means, but trying to help one understand different factors that contribute to overall financial health.

Leave a Reply